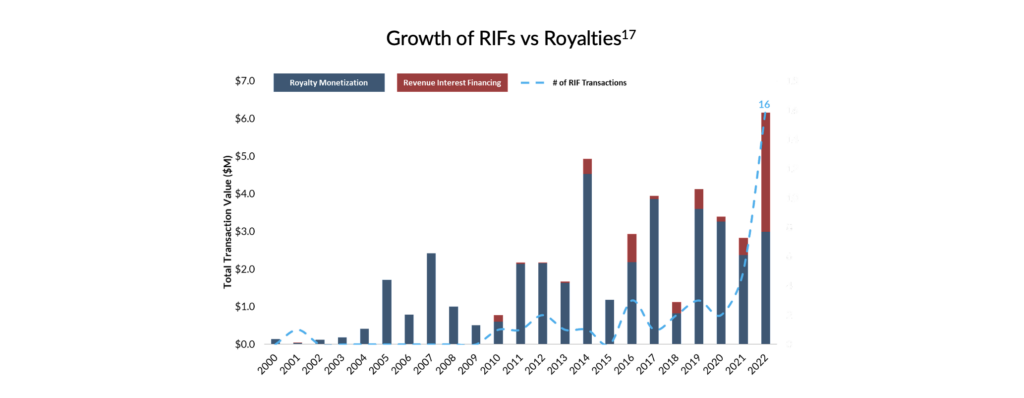

Through recent years, Revenue Interest Financing (“RIF”) transactions have become an increasingly viable financing solution for the biopharmaceutical industry. In a typical RIF transaction, an investor provides capital to a commercial-stage biopharmaceutical company in exchange for royalty payments on topline revenues of the company for a defined period. Between 2021 and 2022, the market for such transactions more than tripled, with $3 billion of RIF transactions completed in 20221. Sagard Healthcare (“SHP”) believes that the market for these transactions remains in its infancy and will grow considerably over the coming years.

Market Context

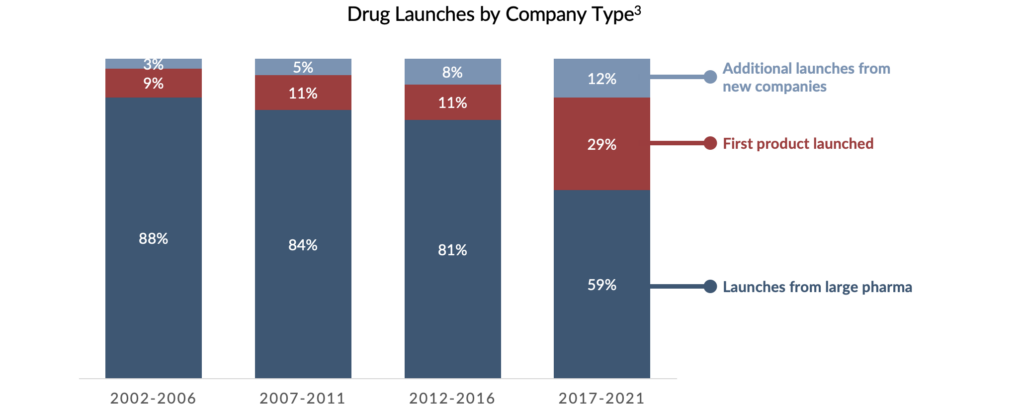

Drug development – including drug discovery and commercialization – is a lengthy, expensive, and risk-fraught process. Historically, the research, development, and commercialization of novel therapeutics were often limited to a handful of large pharmaceutical companies. However, over the last three decades, the pharmaceutical industry has undergone a paradigm shift. Over this period, small- to medium-sized biopharmaceutical companies began to play a larger role in drug development. Today, these firms make up a critical component of this ecosystem. For instance, in 2022, the ten largest pharmaceutical companies globally produced a record-low 5%2 of new pipeline therapies – a stark decline from 2011, during which 13% of pipeline therapies were generated by large pharma. This trend is also evident in drug commercialization. From 2012 to 2016, 19% of new drugs were launched by first-time marketers, compared to 2017-2021, in which new marketers launched 41% of novel therapies. As a result, the pool of creditworthy borrowers has increased.2

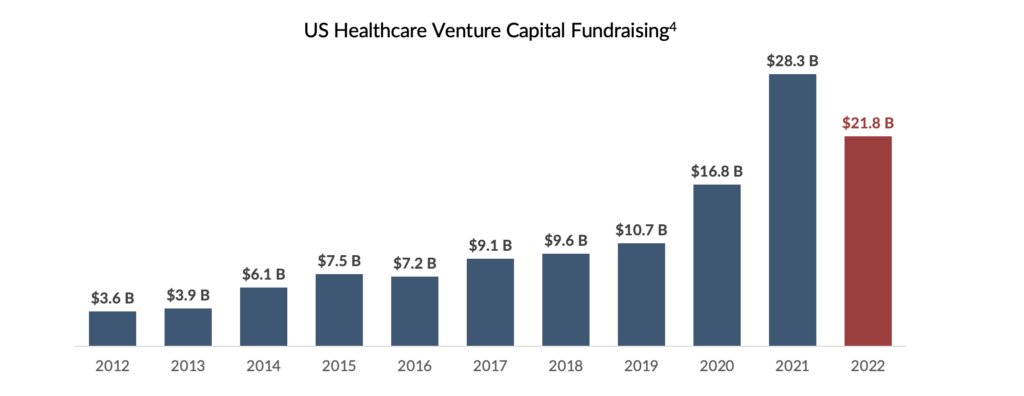

SHP believes the proliferation of smaller- and medium-sized biopharmaceutical companies has been fueled, in part, by the growth of venture capital (“VC”) investment in the healthcare sector. Despite a funding surge in 2021, venture capital investments in biotech have decreased due to heightened unpredictability and a significant drop in stock prices4. Previously, venture debt was an alternative healthcare startups could utilize to strengthen their financial positions. Unfortunately, the recent events surrounding Silicon Valley Bank (“SVB”) call into question the viability of this funding source for healthcare companies in the future.

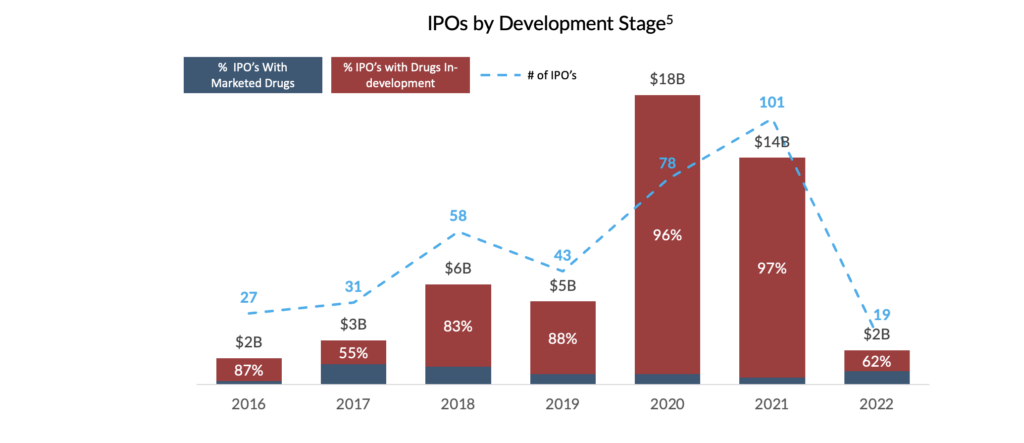

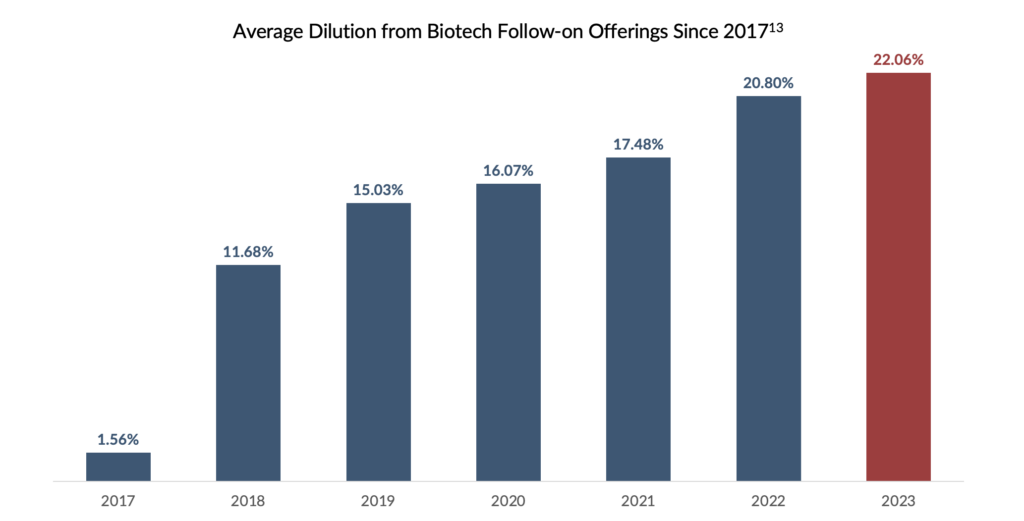

These market dynamics may prolong unfavourable conditions for biotech IPOs and follow-on offerings. Although the years preceding the market downturn demonstrated consistent increases in IPOs for biopharma companies, since 2022, macroeconomic pressures have significantly impacted the IPO market. As a result, without the ability to access the public markets to bridge companies to profitability, this growing cohort of first-time marketers has limited non-dilutive financing options for their new drug launches.

Financing Options

Equity: Overall, equity financing remains a key component of the long-term financing strategy for small- to medium-size drug developers. However, valuations for these growth-oriented firms can be volatile in times of economic uncertainty and “risk-off” environments. Despite being considered recession-resistant, healthcare companies are currently contending with decreasing valuations in the public markets. The XBI, an equal-weighted index of US biotech stocks, has dropped 44% from January 1, 20216. With valuations depressed, follow-on equity offerings have decreased significantly, forcing companies to seek alternative forms of capital. In weighing alternative financing options, many have looked to debt financing as a lower-cost and non-dilutive alternative to raising equity capital.

Debt: While attractive to issuers due to predictable payment schedules and upside retention, a structured loan is often accompanied by restrictive covenants, looming amortization payments, and short-dated maturities – none of which are particularly conducive to a drug’s non-linear and lengthy path to commercial success. More recently, rising interest rates9 have resulted in a surge in the cost of capital for these instruments. Thus, the high cost of capital and reduced operating flexibility for management teams may reduce the feasibility of a credit solution for small- to medium-sized biopharmaceutical companies.

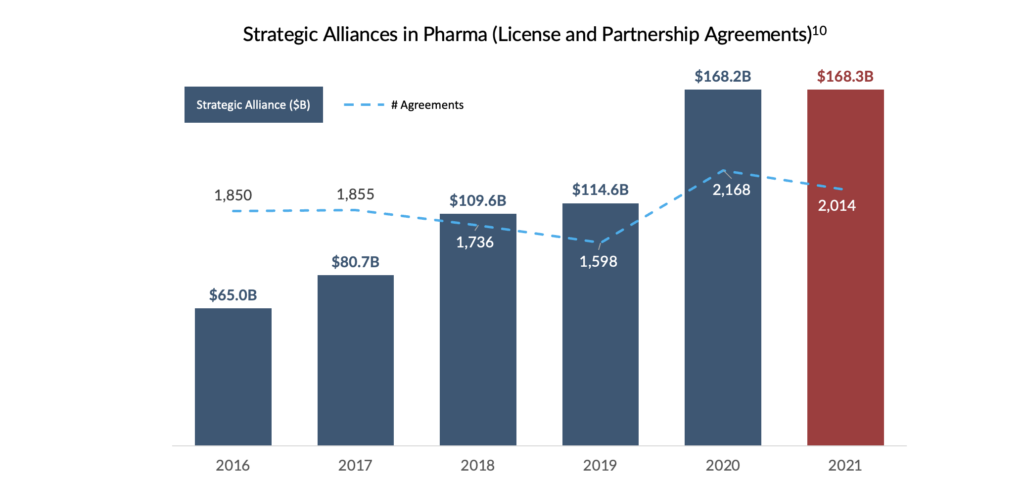

Royalties: In the wake of erratic markets and expensive credit, royalty transactions have become an increasingly prominent tool throughout the biopharma industry. Research institutions and biotechnology companies may lack the resources and/or expertise to carry an invention through clinical development and commercialization. As a result, these companies may elect to license out the rights to these products to more well-established marketers. For licensors, these strategic transactions often result in upfront cash proceeds plus trailing economics, often in the form of royalties on net product sales.

In a traditional royalty monetization transaction, companies with existing royalty entitlements may elect to monetize these passive royalties. This has become a critical source of capital and risk mitigation strategy for small- to mid-cap biotechnology and biopharmaceutical companies. However, royalty monetization transactions may represent a less predictable capital cost than traditional fixed income.

Despite the growing number of licensing deals for early-stage assets7,11, not all emerging pharmaceutical companies have access to a war chest of royalty entitlements to monetize as an alternative financing option. In their pursuit of an alternative to traditional equity and debt capital, these companies have ushered in a new era of alternative financing referred to as Revenue Interest Financing.

Revenue Interest Financing

RIF transactions are a recent innovation in biopharmaceutical dealmaking. This unique structure blends aspects of structured credit and traditional royalties, taking cues from both forms of financing. Historically, royalty-based transactions were reserved for companies that owned passive royalty entitlements through a previous out-licensing transaction and took the form of royalty monetization transactions discussed earlier.

In contrast, a RIF creates a new royalty on top-line pharmaceutical product sales, allowing the marketers of these products to pursue royalty-based transactions. For fledgling biopharmaceutical companies with a new therapy in late development or early launch, this hybrid structure enables them to retain operational control of the clinical programs and commercial plan. At a lower cost of capital than equity and without the restrictive covenants of a credit facility, RIFs represent an attractive financing option for borrowers.

Benefits of Revenue Interest Financing

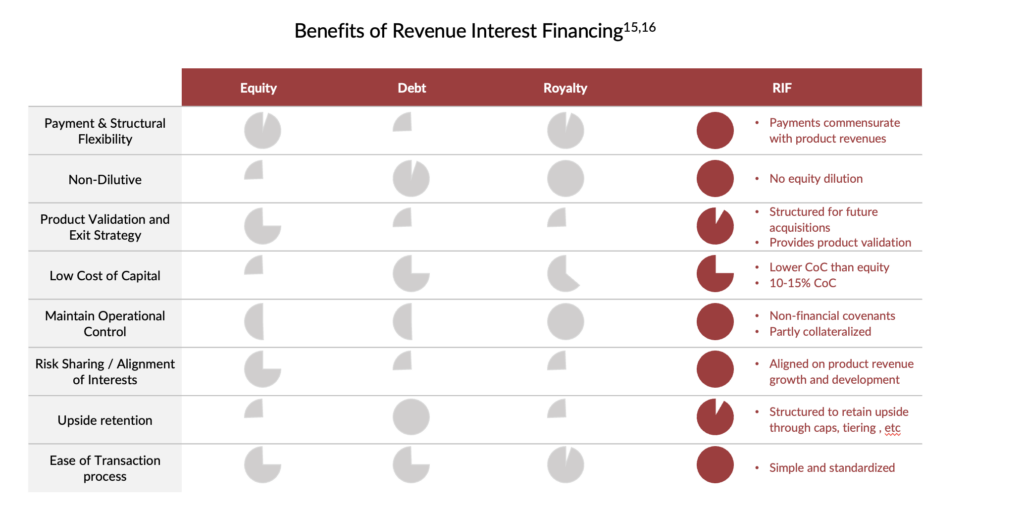

Flexible Payments and Structure: RIFs provide upfront capital to small- and mid-cap biotechnology companies to aid in their commercial launch while offering significantly more flexibility than typical credit facilities. Unlike structured credit, revenue interest payments are not fixed but rather are tied to the performance of the underlying product, allowing companies to make larger or smaller payments based on their quarterly revenues. This structure affords biotechnology companies greater flexibility and the ability to adapt to changes in their product performance.

Moreover, RIFs can be structured to include more opportunities for profit-sharing, tiered royalties, and milestones upon reaching de-risking events (e.g., positive clinical data, regulatory filing, or regulatory approval for a lead product candidate). Companies can also combine RIFs with traditional financing options, such as credit facilities or equity financing, to create a customized financing solution that meets each company’s unique needs.

Non-Dilutive Alternative: Given the challenging conditions prevailing in the follow-on market and the notable rise in the estimated cost of equity within the biotechnology sector12, RIFs offer a less expensive and non-dilutive alternative to equity financing. Biotechnology companies, which typically require substantial capital to support their R&D endeavours and bring their products to market, are particularly vulnerable to the risk of equity dilution. By providing significant upfront capital, RIFs can help biotechnology companies reduce financing overhangs and provide a more stable financial footing for long-term growth.

Product Validation: RIF transactions also validate a product’s commercial potential. RIFs signal to the market and potential acquirers that specialized investors have confidence in the product’s long-term success. Due to the recent downturn in biotechnology markets, the reset of company valuations has made M&A more palatable for large pharma. Coupled with a record high $1.4 trillion in firepower held by the 25 largest bio-pharmaceutical companies, there may be a surge in deal-making in 202314. Several notable deals have already been announced as of the date of this article. The flexibility of RIF structures can allow for the necessary buy-out provisions making it more attractive to acquirers seeking a clear path to acquisition.

The benefits of RIF transactions are presented in greater detail below.

As presented below, the RIF market saw considerable growth in 2022 in transaction sizes and volumes. The market benefited from several tailwinds, including but not limited to the unprecedented increase in interest rates which reduced access to equity capital. More importantly, however, the year brought RIF financing into the limelight and demonstrated the attractiveness of the instrument to management teams assessing their capital needs over the next several years. Despite this growing interest in RIF transactions, SHP believes the RIF market remains underpenetrated. Combined with the proliferation of small- to medium-sized biopharma and the challenging equity financing environment, SHP believes that the RIF opportunity is poised for considerable growth over the next three to five years.

Case Study: Albireo’s $115 Million Revenue Interest Financing

Albireo Pharma, Inc. (“Albireo”) was a Boston-based, clinical-stage biopharmaceutical company focused on the development of novel bile acid modulators for the treatment of orphan pediatric liver diseases and gastrointestinal disorders. Albireo went public in 2016 via a share exchange agreement with Biodel, Inc., which functioned as a reverse merger and capitalized the company with $30 million18.

At the time of IPO, the company’s lead asset, A4250 (now marketed as Bylvay), was in Phase 2 clinical trials for the treatment of orphan pediatric disease progressive familial intrahepatic cholestasis (“PFIC”). To provide the company with additional runway to conduct the larger, more costly, Phase 3 trial of A4250, Albireo monetized its Japanese royalty entitlement for Elobixibat in early 2018. This transaction provided an additional $45 million in non-dilutive cash and allowed the company to focus on developing its lead product candidate19. This was quickly supplemented by an additional $140 million in financing from public stock offerings. The company would continue to tap the public markets for over $800 million through follow-on offerings and shelf registrations before receiving their first-ever FDA approval20.

Bylvay was launched in mid-2021 for patients with PFIC and represented the company’s first commercially available drug. While cash on hand provided a line of sight through early launch, Albireo was also conducting late-stage clinical trials for Bylvay in additional, larger indications. In the summer of 2022, Albireo’s stock price was 32% below its summer 2021 price following an earnings miss and as biotech indices continued to face pressure13. The company had significant cash needs to perform the ongoing clinical trials needed to expand Bylvay’s addressable market and continue building the commercial infrastructure for Bylvay’s first launch into PFIC.

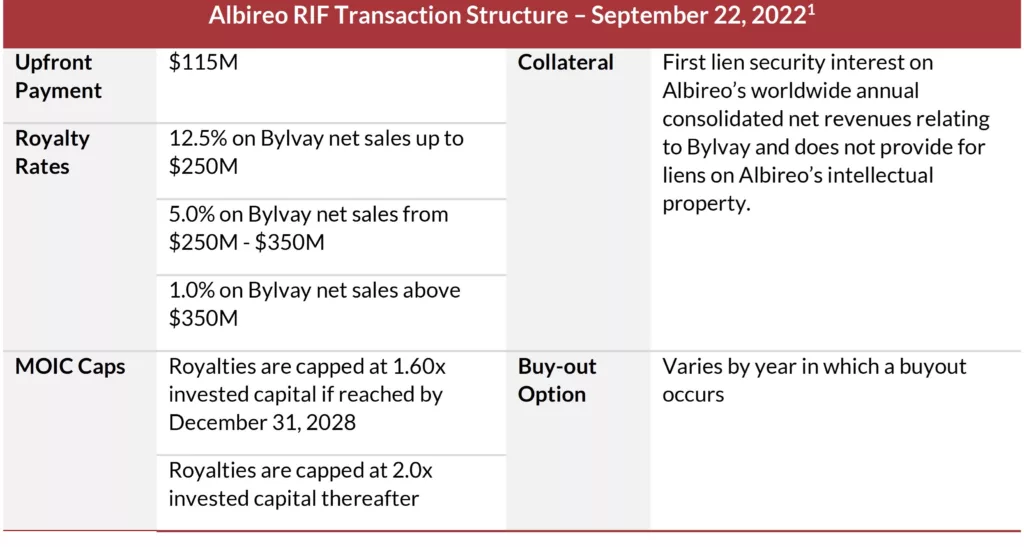

On September 22, 2022, Albireo entered into a revenue interest financing agreement with SHP for $115 million upfront in exchange for tiered royalties on Bylvay’s global annual net revenues. The agreement features a hard cap on multiple invested capital, thereby reducing the cost of capital to the company and allowing them to retain upside in the event of Bylvay’s outperformance. Absent any restrictive financial covenants and immediate interest payments, this RIF transaction provided Albireo with the flexibility needed in its early launch of Bylvay in a small indication.

As part of the RIF agreement, Albireo was provided with a buy-out option that, if exercised, requires the company to pay a multiple on SHP’s invested capital, net of royalties paid at the time of acquisition. On January 9, 2023, Ipsen unveiled its acquisition of Albireo for $952 million in a tender offer for $42 per share plus a contingent value right of $10 per share tied to the potential approval of Bylvay in biliary atresia. Ipsen completed the transaction on March 2, 2023.

“With this agreement, we are significantly strengthening our balance sheet, providing us flexibility, and extending our cash runway beyond at least the topline data readout of our BOLD study in biliary atresia in 2024. These additional resources allow us to build Bylvay into a billion-dollar product and advance the development of our early asset pipeline.” – Ron Cooper, President and Chief Executive Officer of Albireo.

¹ Sagard Internal Analysis. As of January 31, 2023.

²Pharma R&D Annual Review 2022. January 4, 2022.

³McKinsey & Company. September 19, 2022. (Link)

4SVB: Healthcare Investments and Exits. Annual Report 2022. January 6, 2023. (Link)

5GlobalData. January 1, 2023.

6CapIQ. Accessed March 15, 2023.

7CapIQ. Accessed February 5, 2023.

8GlobalData. Accessed February 5, 2023.

9SOFR Federal Reserve Bank of New York Overnight Interest Rate. CapIQ as of February 3, 2023.

10GlobalData. February 5, 2023.

112023 EY M&A Firepower Report. October 31, 2022.

12The Brookline Brief, November 2, 2022.

13Bloomberg. Accessed March 23, 2023. Calculated as (Number of New Shares Issued/Total Shares Outstanding)

142023 EY M&A Firepower Report. October 31, 2022.

15Sagard Internal Analysis. As of January 31, 2023.

16Ladenburg Thalmann

17Sagard Internal Analysis. As of January 31, 2023.

18Albireo Press Release November 3, 2016. (Link)

19Albireo Press Release January 3, 2018. (Link)

20CapIQ. Accessed February 4, 2023.

21Albireo Press Release September 22, 20222. (Link)