Happy Sunday everyone. Today’s piece addresses the risk appetite of investors through their life and how it evolves. Risk appetite can really be thought of in two segments: willingness to take risk and ability to take risk. Over time, your willingness to take risk probably decreases while your ability to take risk could well increase.

I follow a value investing podcast and a few weeks back (Value After Hours S06 E25: Luca Dellanna on his books Winning Long-Term Games and Ergodicity – YouTube ) they had a really interesting guest speaker on, Luca Dellanna. Luca has worked on a concept called Ergodicity. Ergodicity is an interesting statistical analysis which is focused on avoiding large negative events, to compound for a better result. The concept of ergodicity is much easier to explain with examples. In each of the two examples, downhill skiing and Frank v Jane you can see how risk appetite can result in very different outcomes.

Downhill Skiing

Let’s take the first example of a downhill ski racer. The racer is very good but skis on the edge. At each race, they have a 20% chance of winning. If you assume the season is 10 races long, then you would expect the racer to win 2 races per season (on average). Now let’s assume that because of the racer’s aggressive style, they have a 20% chance of crashing in each race and breaking their leg. Now, how many races per year should we expect that racer to win? The answer is 0.7! The reasoning is that if the skier at any time breaks their leg, their season is over, and they don’t get to try and win any other races.

How is this relevant to investing? Well instead of applying skiing, let’s apply this to investing. In a similar example, we could say that a risky investor has a 20% chance of doubling their investment. They also have a 20% chance of losing 50%. What should they do? The answer is they should change strategy and look to lock in lower returns with less downside. Once you lose 50%, you need to make 100% to be back to where you started.

Frank v Jane

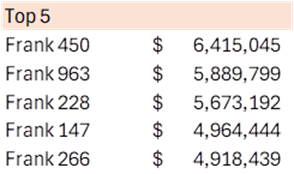

In this second example, let’s take two investors: Frank and Jane. Frank has a very high-risk appetite and is comfortable with annual returns ranging from -25% to + 25%. Jane has a much lower risk appetite and is happy with returns in the -7% to +10% range. Now let’s assume there are 1000 Franks and 1000 Janes and start them with $1mm each. If you run this simulation over 25 years, you will see that the wealthiest of the 2000 population are all Franks. In fact, the wealthiest Jane doesn’t show up until number 14 on the list.

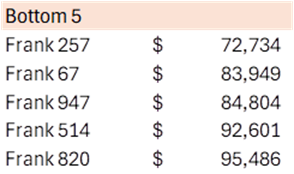

Let’s look at the bottom end of the scale. As you can see below, several of the Franks were close to getting wiped out. The 5 below for example lost over 90% of their wealth.

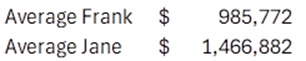

Now let’s look at the averages. The average Frank was down small over 25 years while the slow and steady approach of Jane paid off with strong wealth protection.

Ergodicity and Wealth Management

So, what can we learn from this and apply to wealth management. First, most wealth management clients are probably analogous to the downhill skier and Franks. They were likely risk takers earlier in their lives and in their businesses. Successful entrepreneurs generally have a much higher risk appetite than the rest of the population. Very few Janes will have accumulated substantial wealth over their careers. These clients are slow and steady savers and not necessarily the entrepreneurs.

One of the challenges with wealth management is discussing this with clients and wondering whether it’s time for them to stop skiing and become Janes! That’s how they can best preserve their wealth.

Anyone wanting to learn more about this concept can see Luca’s books in the following link (Amazon.ca). I recommend the “Winning Long-Term Games” book, especially for the next generation of investors.