Happy Sunday all!

It was good to see so many of you in Calgary at the Stampede where much like the equity markets, the bulls were on parade. Bulls on Parade is also a great track from my teen years with the angry vocals of Zach de la Rocha with Rage Against the Machine.

Despite all the geopolitical and trade concerns this year; the equity market has held up well and now seems primed to run into year-end. However, there are signs of excessive risk taking, which may cause concern or at least pauses.

Animal Spirits…Again

As we wrote about in January (Read: MicroStrategy: Animal Spirits) there are once again strong animal spirits in the crypto world. Many firms have taken the lead from MicroStrategy (now just Strategy) and have begun using their balance sheet or excess cash to buy cryptocurrencies. I don’t disagree with the strategy, but I do disagree with the market’s interpretation of these moves.

Let’s go back to the MicroStrategy example from January. Today that firm owns around 600,000 bitcoins at an average price of approximately $70k. The market value of those holdings today is approximately $65 billion USD. However, the market capitalization of that firm is $111bn (check it out on their own website (www.strategy.com ). Their website has a factor called mNAV, which is simply the market value of their holdings divided by their NAV. The current level is 1.90, meaning investors are paying 1.9 times the value of the business to buy the stock. Imagine if they only held U.S. Dollars, it would seem totally irrational to own a stock trading at 1.9 times value.

Follow The Leader

The market has a way of sniffing out irrational exuberance and producing more of the same. There have been several companies that have changed their treasury policy to using cryptocurrencies. Look at Trump Media and Technology Group (DJT) and GameStop (GME), both of which recently announced their intent to buy bitcoin on their balance sheet.

These may be frothy moves higher, but the real excess kicks in when you look at the newly listed firms whose only strategy is to own cryptocurrencies on their balance sheets. I’m pretty sure that strategy is called an ETF!

BitMine Immersion Technologies was a relatively simple business focused on bitcoin mining. On June 30th, they announced they had raised $250m to buy Ethereum and become a crypto treasury business. Needless to say, the market appeared to like it as the stock rallied from $4 per share to a peak of $160 per share in a week! By diluting their equity and using those proceeds to buy a currency, the market deemed the company to be 40x more valuable. The market has cooled on BMNR and as I write this, the stock is down 44% on the day (July 9th).

Bring on the SPACs

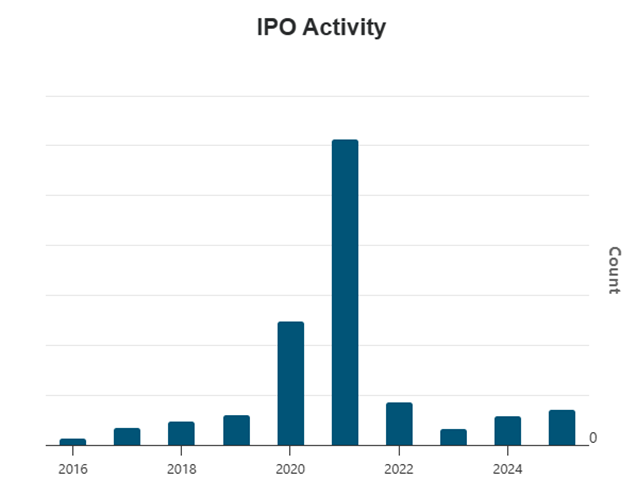

SPACs (Special Purpose Acquisition Companies) are simple in their goal. They are listed stocks with a balance sheet but no business. They are built to go out and acquire a business into the already existing public listing. Think of them as a single opportunity private equity fund. SPACs have been around for a long time and have some very interesting features, which can make their pricing inefficient and susceptible to arbitrage. Issuance of SPACs peaked in 2021, when the market’s demand for high-growth businesses was red hot following the rebound from the dislocations caused by COVID. However, in 2025 we are starting to see signs of life in the issuance of SPACs as shown in the chart below from www.spacresearch.com . There have been 70 IPOs already in 2025, which means we are on pace for the highest number since 2021 (where there were over 600).

SPACs tend to be at the forefront of the market’s demand for new business and in particular high-growth sectors. They were incredibly popular around cannabis in 2021 and this time they are much more focused around cryptocurrencies, stable coins, and the treasury function.

The bulls remain on parade but much like the streets of Pamplona this week, tourists will likely be the ones getting trampled.