HAVRE DE GRACE, MD – July 17, 2025 – Sagard Real Estate, formerly EverWest Real Estate Investors, a leading real estate investment firm, today announced the acquisition of 1621 Clark Road in Havre de Grace, Maryland. In partnership with Chesapeake Real Estate Group (CREG), Sagard plans to develop the 14.2-acre land site into a new Class-A industrial distribution facility. This investment marks the fourth acquisition for Sagard Real Estate’s recently launched moderate value-add, open-end fund, which targets seaport/last-mile industrial, attainable rental housing, and other niche property sub-sectors in supply-constrained, high-growth markets.

Strategically located just 40 miles north of the Port of Baltimore and less than five miles from I-95, the site offers direct access to the Mid-Atlantic’s major logistics corridors. The property’s central location allows access to more than 120 million people, or roughly 35% of the U.S. population, within a 10-hour drive, making it an ideal site for regional distribution and e-commerce operations.

“We’re excited to develop a new Class-A industrial facility with modern, institutional-grade features,” said Tyler Williams, Co-Portfolio Manager for the fund at Sagard Real Estate. “Harford County’s access to infrastructure and population centers, along with restrictions on future industrial development, make it a compelling submarket for industrial investment, aligning with the fund’s focus on supply-constrained locations with structural demand drivers.”

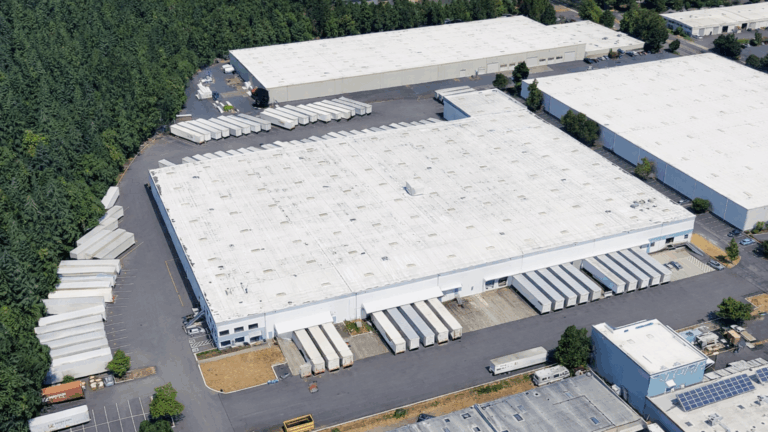

The site is fully entitled for the development of a 168,000 square-foot Class-A industrial distribution warehouse. The building will feature best-in-class specifications, including 36-foot clear heights, 280-foot building depths, 180-foot truck courts, 37 dock-high loading positions, 51 trailer drops, 122 auto parking spaces, and a 2,500 square-foot speculative office suite.

“This investment reflects our continued focus on high-quality, purpose-built assets in markets with strong demand drivers and structural barriers to new supply,” said John Maurer, Head of Equity at Sagard Real Estate. “With the fund’s capital base recently strengthened by additional investor capital commitments, we’re well-positioned to pursue compelling opportunities at what we believe is a highly attractive point in the market cycle.”

The transaction follows Sagard Real Estate’s recent acquisition of Highlands at Morris Plains in Northern New Jersey and underscores the firm’s continued momentum in scaling its portfolio of high quality assets in locations and property subsectors projected to out-perform.

About Sagard Real Estate

Sagard Real Estate is a vertically integrated real estate investment advisor and operator providing investment management services throughout the U.S., including portfolio management, acquisitions, debt origination, asset management, development, and property management for investors. With $5.2 billion in assets under management, Sagard Real Estate offers commercial real estate investment strategies through separate accounts and commingled funds. Founded in 1997, the firm is headquartered in Denver and maintains regional investment offices in New York City, Charlotte, Austin, Los Angeles, and San Francisco metro areas. Sagard Real Estate is a part of Sagard, a multi-strategy alternative asset management firm. For more information, visit www.sagard.com/realestate or follow us on LinkedIn.

About Sagard

Sagard is a global multi-strategy alternative asset management firm with over US$27B under management, 150+ portfolio companies, and 400 professionals. We invest in venture capital, private equity, private credit, and real estate. We deliver flexible capital, an entrepreneurial culture, and a global network of investors, commercial partners, advisors, and value-creation experts. Our firm has offices in Canada, the United States, Europe , and the Middle East.

For more information, visit www.sagard.com or follow us on LinkedIn.

Contact

Bristol Jones

[email protected]