Good morning all and happy Sunday.

I hope everyone enjoyed their summers and families are back into their daily routine. In our household that now means two sons who are learning to drive and have just entered grade 11. One thing that continues to astound my wife and I, is the amount of food our sons can eat. As groceries go into the fridge, they are as quickly leaving! As gym rats, they are always focused on consuming protein and in the case of red meat, that is getting increasingly expensive.

One of the major trends that has been noticeable in commodity markets this year has been the steady increase in the price of cattle. So far in 2025, the price of live cattle has increased by around 24%. However, the increasing price trend has been in place for much longer with the price of cattle increasing by 18.3% annualized over the last 5 years (see chart below):

So, what could be causing the price of beef to increase so steadily? Could it be the costs of production, pushing prices higher?

What Do Cows Eat?

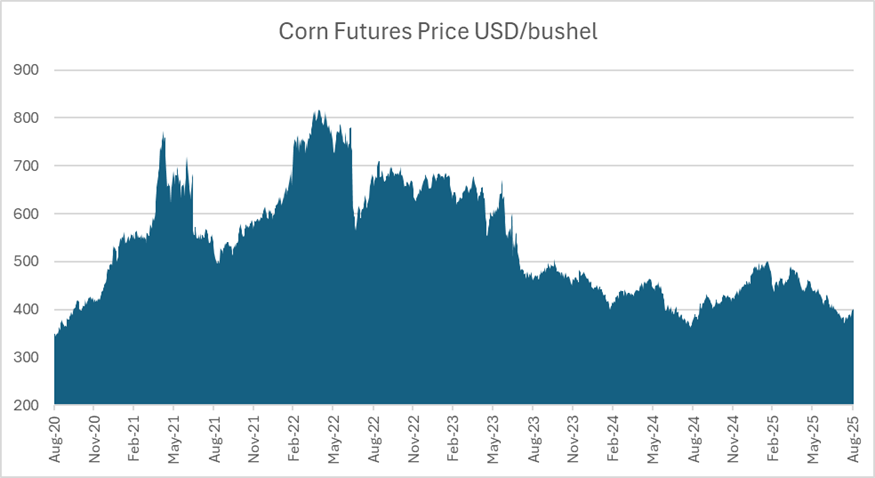

That’s what I needed Google to figure out, but it seems that raised cattle subsist on grass and a collection of different grains, including corn. Given there is no great financial information on the price of grass, I investigated the price of corn over the same period. Over the last 5 years the price of corn has risen just 2.7% annualized (see chart below):

Input costs don’t seem to be the answer to the rising cost of cattle. It is more likely therefore that cattle costs are increasing because people are demanding more beef in their diet.

Acceleration

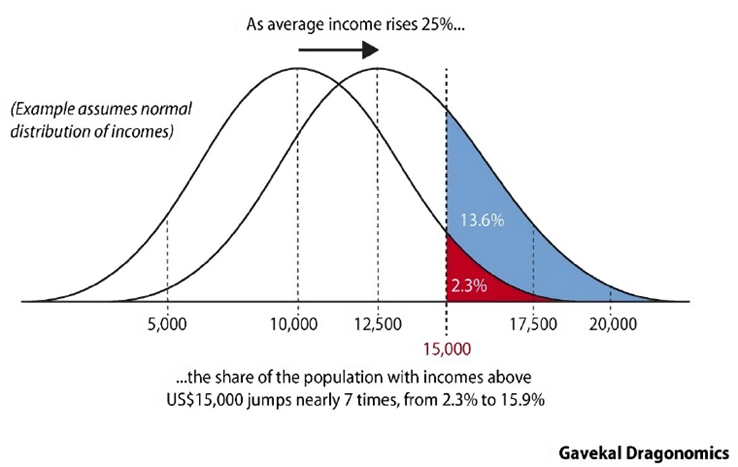

Our good friends at GaveKal point to research from Albert Aftlaion, a French economist and his concept of “acceleration”. It is a phenomenon observed in the demand for certain goods as economies grow. In effect, it points to asymmetric growth in demand for certain products as members of society experience income growth.

As an economy grows, the growth in the average income may push consumers to demand luxuries they hadn’t previously purchased. It may be that the average income grows to levels where the marginal demand for cell phones accelerates at a far more rapid rate than economic growth. As that economy continues to develop, we could see the same with automobiles, investment savings, and even the consumption of beef.

The chart below from GaveKal shows the phenomenon at work with a population with income growth of 25%, leading to a 7-times increase in those earning $15,000 per year. The same would be true at $20,000 and beyond. As economies become richer, the growth in demand for these goods is highly asymmetric.

In terms of diet, emerging economies may well be seeing income levels reach those tipping points where their demand for beef grows exponentially, therefore pushing up the cost of beef globally.

As for our family, we are looking forward to any deceleration in our household beef demand!