Good morning all and happy Sunday.

As many of the readers will know, not only am I a huge fan of baseball, but I also love movies. Baseball movies are my “cup of tea” let’s say. A few weeks ago, we lost an acting legend with Robert Redford passing away.

I love some of his movies including “A Walk in the Woods” (which is a great book by the way), “A River Runs Through It” and “The Sting.” However, “The Natural” has a special place in my movie heart because it combines two passions. “The Natural” is the story of Roy Hobbs, a talented baseball player on his way to greatness, when tragedy strikes. He restarts his career much later and with the help of his bat (“Wonder Boy”), he reclaims his career.

The Natural Rate

In economics there is a concept of the natural rate of interest. It’s not necessarily an observable value but something economists calculate as the optimal rate of interest at any time for one economy. The natural rate is a real rate of interest, meaning it is measured net of inflation. The natural rate has important implications as it points to the real level of interest rates where investment levels will maintain optimal levels of investment, employment and inflation.

So why does this theoretical rate matter? Policy makers (particularly central bankers) are often looking for measures to gauge interest rates for the current economic situation. They refer to the natural rate to understand whether real interest rates (the difference between policy rates and inflation) are over stimulating (easy) or contractionary (tight). Simply put, if the policy rate is below the natural rate, monetary policy is stimulative and if the policy rate is above the natural rate, monetary policy is restrictive. Maintaining policy rates too low relative to the natural rate is likely to cause overheating (inflationary), while policy rates that are too high, risk low growth and unemployment.

Canadian Natural Rates

Based upon calculations from the Federal Reserve Bank of New York, the latest natural rate of interest in Canada is 1.7%, while the bond market (using the 10-year Bank of Canada bond) is offering a real yield (after implied inflation) of 1.48%. Therefore, the market is factoring in real yields that are lower than the natural rate, which could be deemed to be slightly stimulative to the economy. The chart below shows the history of the natural rate (white line) as well as the implied real yield on a Canadian 10-year government bond (yellow line) over the last 45 years.

Based upon this approach, Tiff Macklem isn’t too far away from the natural rate.

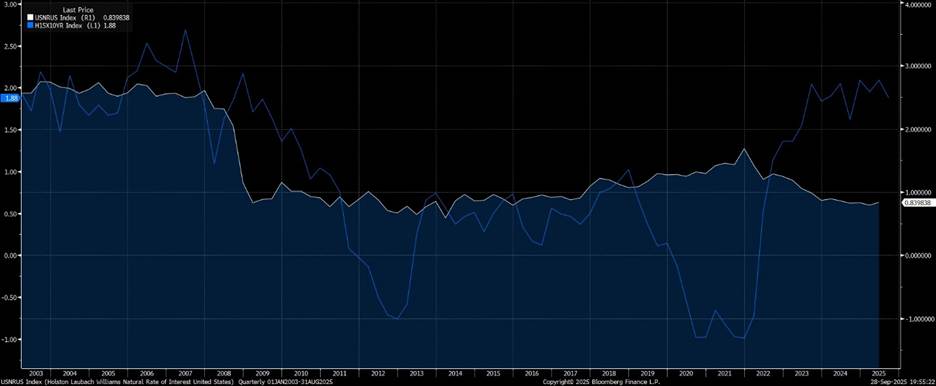

US Natural Rates

So how does a similar measure look in the US versus market rates? As the chart below shows, the natural rate of interest (white line) is considerably below the market’s implied real interest rate (blue line). This points to restrictive policy, maybe enforcing many market participants’ view that Jerome Powell and team should continue to cut rates.

Hopefully by the time you read this the A.L East Champs, Toronto Blue Jays are thriving in the post season.

I’m looking for a Roy Hobbs or Joe Carter moment from one of those players!