I hope all my fellow Canadians had a great Thanksgiving weekend and hopefully the Blue Jays are still in contention as you read this.

The word debasement has started to pop up a lot more in the media over the last few months and I think it’s an interesting topic to discuss. So, what is debasement and why is it being discussed today?

Debasement

Debasement isn’t just a place in Chicago where fans go to watch “Da Bears”, it has historical roots in the derivation of the word. Dating back to Rome and Tudor England, less scrupulous holders of coins (particularly silver and gold coins) would melt down those coins alongside less valuable metals, such as nickel and tin. The derivation of the word literally means to lower the quality of something.

The Great Debasement

Through the 1540s and 1550s Tudor England went through a period known as The Great Debasement. On the back of Henry VIII’s wars with France and Scotland, the Crown was short of funds and turned to the royal mint. There was a shortage of silver to mint new coins, so the coins were melded from silver and other metals. The silver content of the coins was debased from 92.5% of coins to a mere 25% by 1549. Although the currency of the coins held the same value, their metal content had been drastically changed and devalued.

Hidden Taxation

If money supplies are increased, then the inherent value held by that currency should also decrease. By reducing the value of a currency, you are in effect taxing the purchasing power of the economy. Today the phrase is used more commonly to describe the rapid increases in money supply through fiscal and monetary policy response to the financial crisis and then COVID.

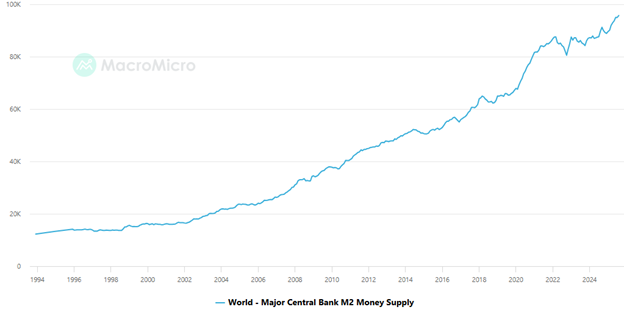

As the chart below shows, the global money supply (from the major central banks) has increased by 370% since 2007 or 780% since 1993. Increasing money supplies in the face of strong economic growth aren’t as bad but over these periods, money supply growth has far outstripped GDP growth.

In effect, global central bankers have been devaluing their currencies with increasing supplies. Debasement has been in effect for a long time.

Protecting From Debasement

If debasement is the erosion of value through less constrained supply of money, then alternative stores of value should serve as protection from the force. There are three main sources of alternative stores of value:

- Currencies: Other currencies outside that of your economy may serve to protect you from debasement. However, we are in a world today where many supplies of currencies around the world are increasing, offering little protection. More controlled currencies such as the Renminbi may prove difficult to source and hold.

- Precious metals: Gold and silver have worked for many centuries as a source of debasement protection. In the example of Tudor Britain, simply holding silver would have saved you from the circulated coins being devalued. Gold has been the main source of protection not only for citizens but for nations for many centuries. Today it appears to be the go-to store of value for the world’s central banks, driving prices higher.

- Cryptocurrencies: Bitcoin and other cryptocurrencies have one key feature which makes them appealing as a debasement trade: controlled supply increases. In the case of Bitcoin, the annual increase in supply is controlled algorithmically, and at a rate far lower than many fiat currencies. Therefore, it has the main attribute as a store of value, with constrained supply.

I’m often asked about the relative merits of the different assets above. Should we hold silver over gold? Bitcoin over gold?

Personally, I think they all have their merits, but I don’t tend to overthink it.

Gold is what the large institutions and importantly central banks are buying. All the other assets have similar attributes but appear more speculative around the same theme.

Gold is the granddaddy of the debasement trade.