Happy new year!

I hope you all had time to relax, reflect and get ready for 2026.

I managed to get away with my family over the break and spend some quiet time in the sun. I read 1929 by Aaron Ross Sorkin and thoroughly enjoyed the read (thanks to a few of you for recommending it to me).

The story is very rich in characters in a time when the world was changing rapidly and there seemed to be very few bounds to activities. While reading the book and observing financial markets, I was struck by the similarities between recent market volatility over the break and certain events from 1929.

I’m not one to worry about the sky falling, but I did see some analogies to specific pockets of the market over the break. One common thread between 1929 and the recent volatility in silver and other precious metals was the role of leverage — and how volatility itself can breed more volatility.

Margin Requirements

When investors want to increase their exposure to an asset beyond their current cash levels, they can buy on margin. In other words, you are creating a levered exposure. When trading on margin, a broker will require you to put up a certain level of margin requirement. When buying cash securities (assets where the purchase price is paid in full on settlement), then the broker is in essence lending you the cash to fund the rest of the purchase (in exchange for a lending fee).

In the case of futures contracts, these margin levels are controlled by the exchanges they trade on. Brokers will require some initial margin (minimum collateral needed to enter the trade) as well as some variation margin (collateral posted to protect the broker from the price movements in the asset over time). The brokers and exchanges can increase their margin requirements over time, either specific to an asset (usually because the asset price becomes volatile) or if they are concerned about the credit worthiness of an account.

Silver in December

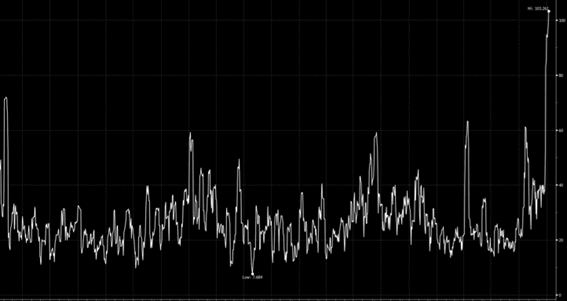

Silver, much like other precious metals, had very strong performance in late November through the end of December. In fact, over the last 45 days the metal has been up around 60%. When an asset moves that quickly in that short a period, it is unlikely to be in a straight line. The increased volatility and cost per contract will often drive the exchange to increase their margin requirements on futures contracts. The chart below shows the rolling 10-day volatility of silver futures over the last 5 years. As the chart shows, the recent rise in volatility was very high, pushing exchanges to change their margin requirements.

When exchanges increase margin requirements, they are often trying to calm speculation. The change to margin requirements for silver did in fact have that effect, although temporarily. Why didn’t the change in margin lead to persistent selling?

One reason is that margin requirements are set in terms of dollars per contract. Although the CME (Chicago Mercantile Exchange) increased margin requirements by 30%, the price of the contract had already rallied 60%. Therefore, speculators were still able to manage at very high leverage (if they wanted). For a fascinating look back at one of the most dramatic periods in the history of silver, the story of the Hunt brothers and their influence on the market in the late 1970s is well worth exploring. In fact, there’s a long-standing rumour that the characters Randolph and Mortimer Duke — from one of my all-time favourite films, Trading Places — were inspired by the Hunt brothers.

Precious metals have a secular tailwind behind them as central banks across the world continue to acquire the metals as an alternative store of value. Some have pointed to the increase in the market capitalization of the gold ETFs as proof of increased speculation from retail investors but again adjusted for performance the growth levels in these ETFs are still quite small.

Those of you that have the time, read 1929 and see how the increased margin requirements put in place to halt rampant speculation and excess risk taking, led to the demise of the stock market that year.