Good morning and happy Sunday to all.

Hopefully we all get a period of relative calm after a fast-paced start to the year, with a Blitzkrieg of policy and announcements from governments around the world.

I recently celebrated my two-year anniversary with Sagard Wealth, and I couldn’t be happier with the relationships I’ve built and the results we have created for our clients over that period. This last year in particular has proven that when the macro noise sits above everything, focusing on the signal can be rewarding, proving that active management has an important role.

One asset that has already started 2026 just like it finished in 2025 (and 2024) has been gold. To celebrate my anniversary, I went back to the first Sunday Reads that I wrote to “remix” the points around gold and its portfolio role. Below you’ll find the original Sunday Reads from 2 years ago with the addition of a small update I’ve added to the end.

Sunday Reads – Fool’s Gold – January 2024

Personally, I think gold has and should play a role in complete portfolio management and serves as a good preserver of wealth. However, I think it is useful to come at this with a pragmatic approach. Many investors have dogmatic views of gold that can be best expressed by the titles and lyrics of two fantastic 1980’s hits from my native UK:

- “Gold” the 1982 ballad from Spandau Ballet

- “Fool’s Gold” the 1989 anthem from The Stone Roses

Let’s investigate both camps and argue both sides.

“Gold, always believe in your soul. You’re Indestructible” Gold, Spandau Ballet, 1983

Gold bugs (those that are constantly bullish and optimistic on gold) will point to the key fact that all the gold ever mined, still exists in “circulation” today. The current base is fixed and the rate of increase from gold mining is relatively slow. Therefore, gold should retain value as a form of exchange over time because it has a controlled supply increase. Economic theory points out that price is simply the level where demanders and suppliers agree on exchange. If supply is fixed, then demand is the key factor and therefore drives price. If we had a lot more gold bugs, then the release valve would likely come from price and not increased supply (it takes many years to build a new mine and then get that supply to the market).

Gold has been the ultimate store of value for hundreds of years. Gold fanatics will point to the yellow metal’s ability to act as a form of exchange that works incredibly well in times of conflict, uncertainty, and sanctions. That group will also point to the metal’s ability to protect a portfolio during times of inflation.

“But I know in my heart, you’re not a constant star” Fool’s Gold, The Stone Roses, 1989

There is also a large group of investors that will point to the fragility of gold’s role as a store of value. Gold has worked historically as a store of value because it has been a prized asset and a form of exchange. For several periods, gold was used to back currencies and therefore was not only a store of value but also derived the price of most international trade. However, since 1971 the gold standard has not been in place and therefore there are far less links between the financial world to gold.

If gold’s role as a form of exchange is dwindling, then gold’s value lies in the eye of the beholder. If humans place less interest or desire for gold, then the value is less important.

The Mixtape: Portfolio View

My view lays somewhere in between as I think gold’s role in portfolios plays a key part depending upon the market environment. I think gold does play an important role in protecting client portfolios not from inflation but from the debasement of currencies. Debasement originated from the practice of melting coins, in order to mix in less valuable metals, directly decreasing the inherent value of the currency. Debasing a currency simply means that the supply of money is increasing at a faster rate than demand.

Today we are in that world. The U.S. Treasury will need to issue around $10 trillion worth of debt this year due to the combination of refinancing maturing debt as well as funding the huge fiscal deficit in their budget. It is likely this will happen with the increase in the money supply, effectively reducing the value of the stock of U.S. Dollars relative to fixed stock currencies and assets.

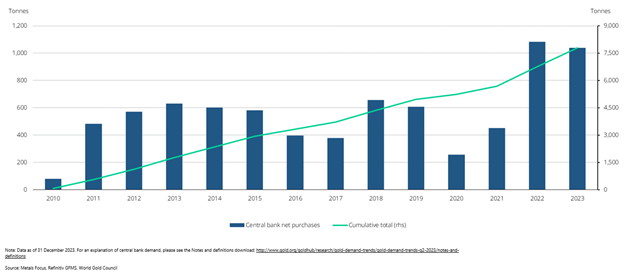

Foreign central banks have seen this shift occurring and have been reducing their holdings of U.S. Treasury bonds. As the chart below shows, gold has been one asset they have increased holdings of.

In the absence of this large central bank buying, gold tends to perform better in periods where the real return from cash is low (interest rates minus inflation). In those periods, gold stores value just as well as cash. When real rates are high, investors would prefer to own assets that offset inflation with higher interest rates. Gold’s performance over the last 2 years has defied the long-term relationship with real yields (gold is up around 14% while real yields have jumped nearly 3%) because of the increased demand from central banks.

If we head into a period of lower inflation and therefore lower real rates, we may see portfolio managers increase their holdings of gold at the same time central bankers are. This could lead to strong performance for the metal.

I recommend that anybody wanting to delve into the history of the economics of gold, pick up the excellent read by Peter Bernstein, “The Power of Gold”. The fact that Paul Volcker, regarded as one of the best Federal Reserve Governors, wrote the foreword, speaks to the quality of the read.

The Remix

In the time since I first wrote this piece, the price of one ounce of gold has increased by a staggering 140%. Through that period the narrative around gold ownership has changed a little with less focus on the relationship to U.S. real interest rates (a negative long-term correlation) and more to the safe-haven nature of the metal. As mentioned in the original piece, the marginal demand for gold has come from central banks across the world. A key event was the seizure of U.S. Treasury holdings by the U.S. Treasury from Russia, following their invasion of Ukraine. This event may have refocused the central bankers and influenced what assets they are holding on their balance sheet with their reserves. In many ways gold has become an alternative to holding government debt, albeit without any carry or yield.

Some have pointed to the increased retail participation in gold ownership as a sign of exhaustion of the trend. If you look at the largest physical gold ETF in the world, GLD (NYSE listed), its market capitalization has grown from $62 billion to $165 billion over that same two-year period. That’s an increase of 166% over the same period, which is barely more than the 140% increase in the cost of the metal.

Therefore, the average U.S. investor has not been increasing their exposure significantly. The same is not true for ETFs or holding vehicles outside the United States, where the adoption is growing at a faster rate.

Bottom line: Today gold plays a role as not only betting against the U.S. Dollar but also adding security to a portfolio.