Headlines out of Hollywood and Washington last week: the passing of comedy legend—and proud Canadian—Catherine O’Hara, along with the White House’s nomination of Kevin Warsh as the next Chair of the U.S. Federal Reserve. Will Kevin be Home Alone, up Schitt’s Creek, or Best in Show?

Home Alone

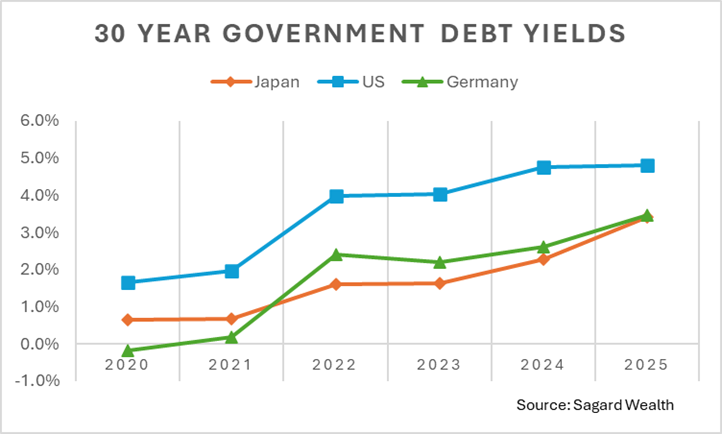

Over the last 5 years the bond market has been sending a strong signal to policymakers and investors. As developed nations continue to run with fiscal deficits (spending more than they earn), they have needed to increase their debt loads (issuing more bonds). However, the market demand for these bonds has been decreasing, therefore increasing the borrowing costs for governments. As the chart below shows, the market has been demanding a higher yield for owning the sovereign debt of the U.S., Germany, and Japan.

Central banks do not directly impact the yield on longer-term government debt, which is more influenced by market forces. The back end of the yield curve (10 years and above maturity debt) tends to be more influenced by inflation expectations. Therefore the “back-end” of the curve could be speaking to pending inflation or is it a dramatic decline in demand for this paper?

Demand for longer-dated government debt has been dropping from one source: other central banks. Many central banks own reserves in the currencies and debt of other nations as a store of value. The idea being that their trade surpluses (where they export more than they import) can be held in liquid securities, which can always be sold if they need to protect their currency. As an example, if the Bank of Japan wanted to protect the Yen from further declines, they could sell their holdings of U.S. Treasury bonds and buy Japanese government bonds (JGBs). This transaction would result in net selling of U.S. Dollars and net buying of Yen, therefore pushing the price of the Yen higher.

More recently, central banks (particularly within Asia) have been buying gold in place of foreign government bonds. The National Bank of Poland recently reported they have acquired 550 metric tons of gold, more than the European Central Bank. As other nations lose faith in the debt of developed sovereigns, we should expect to see them seek more alternative stores of value. Will we see more governments fortify their balance sheets like Kevin McCallister? To quote Kevin “This is it, don’t get scared now”.

Best in Show

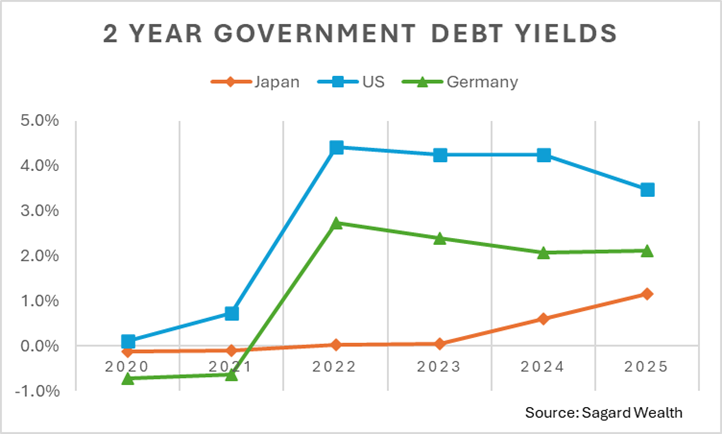

Central bankers have much more influence over the front-end of the yield curve (short term debt) where the policy rate is much more impactful. Most central banks have been cutting their policy rates over the last 2 years, as inflation has cooled down. These changes tend to feed through quickly into the yield of shorter dated debt, including the 2-year debt. The chart below shows the yield of 2-year government debt across the U.S., Germany and Japan.

Kevin Warsh is seen by many as a hawkish policymaker, meaning he’s more likely to lean towards protecting from inflation (keeping rates elevated) than a dove (cutting rates and “running it hot”).

I think that unemployment will send the key signal here. If AI continues to add to labour productivity, then we can expect to see further job losses, driving more cries for rate cuts.

For now, the bond market looks to be up Schitt’s Creek.

Thanks for the laughs, Catherine.